The Budget App:

Your Financial Companion

iCoderz developed The Budget App to revolutionize financial management. With effortless expense tracking, smart goal-setting, and expert guidance, we have built an app that empowers users to gain control over their finances and confidently secure their financial future.

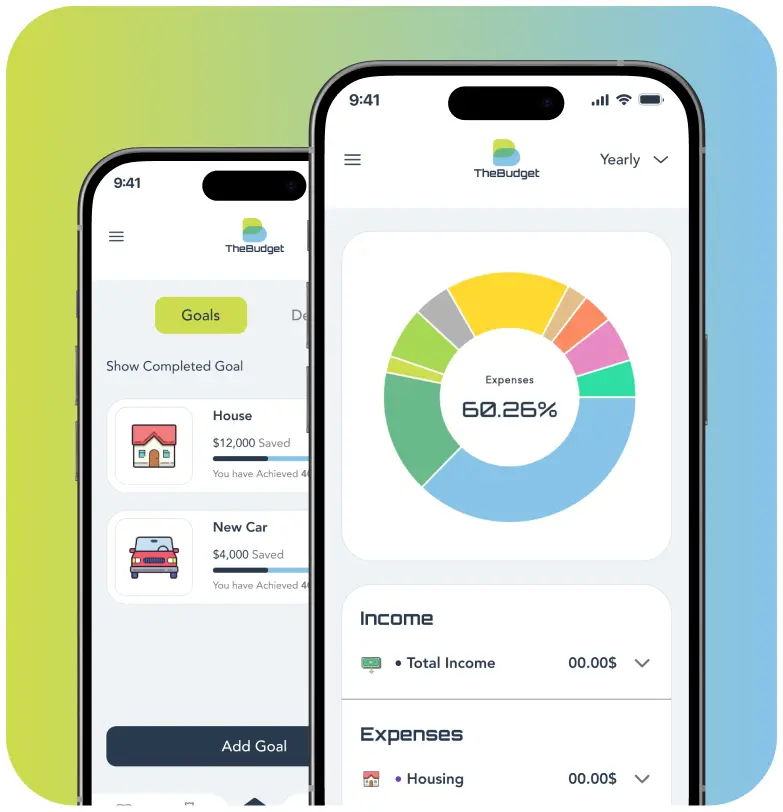

Project Overview: The Budget App

The Budget App, developed by iCoderz Solutions, helps users easily manage their finances. It offers expense tracking, setting financial goals, managing debts, and monitoring net worth. The app also provides reminders and expert coaching to guide users toward financial success. We built The Budget App with Flutter for a smooth experience on both iOS and Android. Our secure and scalable backend is powered by Laravel, ensuring reliable financial management. Take control of your finances with The Budget App and build a secure financial future.

Proposed Team to be Involved

Project Manager

UI/UX Designer

Frontend Developers

Backend Developers

QA Engineer

DevOps Engineer

Financial Expert/Advisor

Requirements

The client asked for The Budget App to give users a basic financial planning system to handle budgets and expenses while directing their money growth and establishing financial plans. Users can monitor their spending, manage debts, set financial alerts, and earn personal budget advice from the app. The application should have an enhanced version that gives subscribers additional features and capabilities. Through the admin panel, users can be monitored alongside financial guides and coach profiles. The client requested the app be built with Flutter for cross-platform support and Laravel for a secure, scalable backend, ensuring global accessibility.

Key Features

of The Budget App

Customer Features:

Admin Features:

Advanced Features:

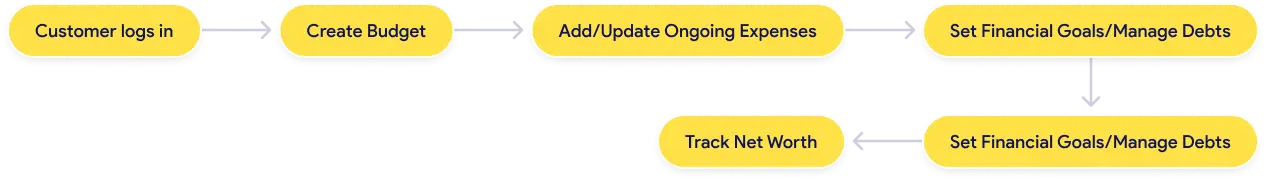

Our Approach:

Streamlined Customer Journey

Customer Flow:

Challenges and Solutions for Budget App

Challenge:

We encountered difficulties in accurately managing and categorizing budgets and expenses for our users, particularly due to their varied spending habits across different categories. We needed to ensure smooth categorization while allowing users the flexibility to tailor their experience.

Solution:

We implemented a flexible and customizable category system, allowing users to define and adjust categories based on their spending habits. We also regularly updated and optimized the system to accommodate new expense types, ensuring it remained adaptable to users' needs.

Challenge:

A significant challenge we faced was automatically updating our users' financial goals and debt payment progress regularly (monthly or weekly) while maintaining real-time accuracy. This task became particularly complicated due to the diversity of user goals, payment methods, and the necessity for seamless synchronization.

Solution:

To overcome this, we designed a robust automated tracking system that syncs with our users' financial institutions, allowing for accurate and timely updates of goal and debt payments. We allowed users to set custom intervals (monthly or weekly) for progress updates, along with automated reminders and notifications to keep them on track with their financial commitments.

Challenge:

Keeping our users' net worth calculations accurate was a major hurdle, as it required real-time updates reflecting changing assets, debts, and market conditions. We had to ensure these calculations were precise while considering various financial factors to maintain user trust and the reliability of our app.

Solution:

We incorporated real-time data sources and APIs to automatically refresh users' assets, liabilities, and market values, guaranteeing accurate net worth calculations. We also established regular updates for financial data like account balances and debts, employing financial algorithms to address any inconsistencies. Furthermore, we made net worth calculations transparent, enabling our users to review and comprehend the details of their financial situation.

Our App Screens

Ready to Create

Your Perfect Budgeting App?

Results and Achievements

Technology Stack for The Budget App

Framework

Flutter

State Management

Provider

Getx

Language

Laravel

Vue.js

Real-Time Updates

Socket.io

Relational

MySQL

NoSQL

Firebase Firestore (optional)

Payment Gateway

Stripe

Notifications

Firebase Cloud Messaging (FCM)

Hosting

Cloudways

Storage & CDN

Amazon S3

AWS CloudFront

Biometric Authentication

Face ID

Fingerprint

Framework

Vue.js

Take Control of Your

Finances Today

The Budget App proves iCoderz Solutions leads the way in personal finance technology. Evolving from a simple tracker, it offers advanced features like expense tracking, debt management, and expert financial coaching. The app simplifies money management by scheduling alerts and financial tools so users can effortlessly reach their targets. This upgrade shows how iCoderz builds simple yet effective solutions that help users globally.

Looking for the Right Digital Partner?

We can help you develop custom digital software solutions.